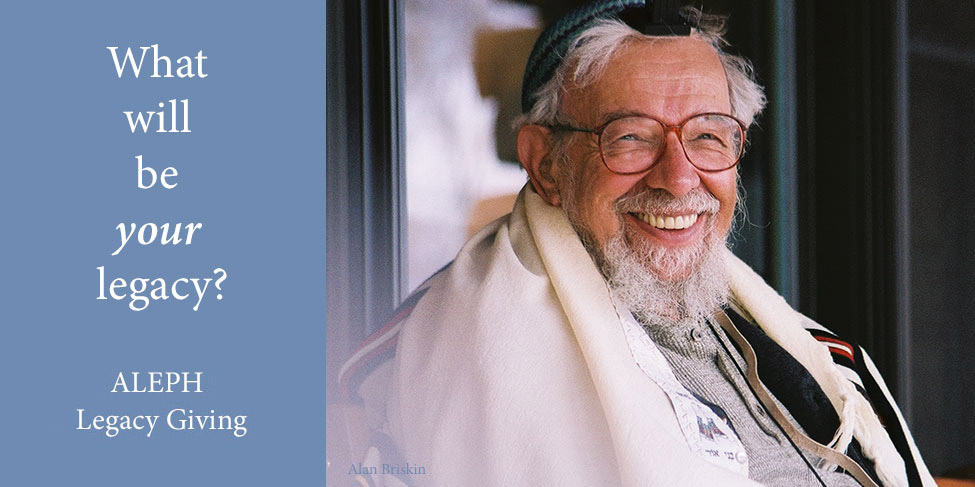

ALEPH Legacy Giving

Your Legacy Can Nourish Jewish Futures

What if the fruits of your life’s work could continue to nourish vibrant, inclusive Jewish life — long after you’re gone?

By making a legacy gift to ALEPH: Alliance for Jewish Renewal, you help ensure a thriving Jewish future, one rooted in spiritual depth, community, creativity, and inclusion. Thanks to your generosity, ALEPH will continue to create vibrant Jewish communities led by our graduates — rabbis, cantors, educators, and spiritual leaders — who serve communities with compassion and courage across and beyond denominations.

We know there are so many out there who are searching for a personally relevant Jewish experience. With your support, we will reach them. In this era of profound change, together we can create trauma-informed, joy-filled, and welcoming Jewish spaces.

Planned giving isn’t just for the wealthy.

Anyone can leave a legacy without it impacting their finances right now.

Let’s explore what’s possible.

Galya Segal, Development Director

What Is a Legacy Gift?

Legacy giving allows you to support ALEPH in a lasting, impactful way — often while providing financial or tax benefits for you and your family. These gifts typically come from estate plans, retirement accounts, or other financial assets.

How You Can Get Started

We invite you to explore your options for legacy giving. Whether you’re just starting to plan or ready to take the next step, we’re here to help.

📧 Contact: Galya Segal, Development Director

📨 galya@aleph.org | ☎️ 215-247-9700 x200

Let us know if you’ve already included ALEPH in your plans — we’d love to thank you and support your journey.

Here is a downloadable form to share your Legacy Giving Plan with us.

Here is a website to make your will online for free.

Popular Options Include

Bequest

– Create your Legacy through naming ALEPH in your will or trust

Including a provision in your will or revocable trust brings peace of mind—you’ve cared for your loved ones while supporting a vibrant Jewish future. Just a simple provision in your will or revocable trust can support the Jewish community well into the future.

Your gift, your way: Choose a dollar amount, specific asset (real estate, stocks), percentage of your estate, or remainder after other bequests.

Complete flexibility: Your circumstances change? So can your gift. Revocable trusts and wills let you modify or remove provisions anytime.

Immediate impact: While your gift works in the future, the peace of mind starts now.

A simple provision today ensures Jewish communities thrive for generations to come.

Beneficiary Designation

– Include ALEPH in your IRA, 401(k), brokerage or savings account.

If you’re like many people, you probably will not use all your retirement assets during your lifetime. Why not allocate the remainder to charitable giving and help support new Jewish leaders? These gifts can include retirement accounts, such as a 401(k), 403(b), or IRA; health savings accounts; donor advised funds; brokerage accounts; and other financial accounts, including CDs, money market, savings, and checking, that allow transfer on death (TOD) or payment on death (POD) designations. You have a variety of options for giving Jewishly. Through a simple beneficiary designation form, you can add ALEPH: Alliance for Jewish Renewal as a beneficiary of any percent or amount you choose.

Another approach is to name ALEPH: Alliance for Jewish Renewal as secondary or contingent beneficiary in case someone you’re providing for can’t claim their portion.

To name ALEPH: Alliance for Jewish Renewal on your beneficiary designation form, please use the following address:

ALEPH: Alliance for Jewish Renewal

P.O. Box 35118

Philadelphia, PA 19128

EIN: 23-2081703

Relationship: 501(c)(3) not-for-profit organization

Charitable Gift Annuity

– Receive income while supporting ALEPH

Create reliable retirement income while supporting ALEPH’s vision of a vibrant Jewish future.

How it works: Donate cash, appreciated securities, or IRA funds to ALEPH. In return, receive fixed payments (monthly, quarterly, or annually) for life—for yourself or someone you designate.

Triple benefits:

- Steady income for life at attractive payout rates—unaffected by market volatility

- Immediate tax deduction when you establish the annuity

- Capital gains tax savings when funded with appreciated securities

Flexible timing: Choose immediate payments or defer for one or more years to increase both payment amounts and potential tax deductions.

Tax advantages: A significant portion of your annuity payments is typically tax-free, maximizing your after-tax income.

Your gift at work: While you receive lifetime payments, your contribution helps ensure Jewish Renewal thrives for generations.

Consult your financial advisor to determine optimal timing and funding options for your situation.

IRA Rollover

– Make a gift, tax free, up to $108,000

A qualified charitable distribution (QCD) is a wonderful option for people 70 ½ and older. That’s because it allows you to make a gift to ALEPH — from $100 to $108,000 — without the distribution counting as taxable income. This giving option is a direct contribution made from your traditional or Roth IRA to a public charity like ALEPH, and it is a great option if you don’t normally itemize your charitable deductions.

Appreciated Stock Donation

– Avoid paying capital gains tax

When you donate your appreciated stock, mutual funds, or bonds to ALEPH, we sell your gift and use the proceeds for life-changing work. You avoid paying capital gains tax and might also be eligible for a charitable income tax deduction.

As an example of how you and ALEPH benefit*, the market value of a gift of $100,000 has a $68,500 cost to you when you factor in cost basis ($50,000), charitable deduction ($24,000**), and capital gains tax avoided ($7,500***).

*Figures may vary based on the income tax laws in your state.

**Calculation is based on a 24% federal income tax bracket.

***Calculation is based on a 15% long-term capital gains tax rate.

Donor-Advised Fund

– Recommend a gift from your DAF

A simple, flexible way to manage your charitable giving with significant tax benefits.

How it works: Complete an application and make a tax-deductible contribution to establish your fund (often named after your family, like “The Jones Giving Fund”). You retain advisory privileges to recommend investments and charitable grants, while appointing family members as co-advisors or successors.

Funding options: Contribute cash, appreciated stock, real estate, or other complex assets during your lifetime. You can also designate your DAF as beneficiary of life insurance, retirement plans, or trusts.

Tax advantages:

- Immediate income tax deduction up to full fair-market value

- Estate tax charitable deduction for bequests

- Potential state tax savings on inheritance and estate taxes

No startup costs beyond your initial contribution. Your irrevocable gift grows tax-free while you recommend when and where to distribute grants.

Legacy planning: DAFs provide an excellent vehicle for multi-generational giving, allowing your charitable values to continue through your family.

These options are simple, flexible, and can offer financial benefits to you and your loved ones — all while securing ALEPH’s mission for future generations.

Why I Chose to Leave a Legacy

“ALEPH and the legacy of Reb Zalman have provided me with many opportunities for deep learning, occasions such as Kallah to gather in community, access to many and diverse teachers, and overall a joyful re-framing of my Jewish spiritual life.

Providing a legacy gift to ALEPH allows me to pay back some of those bounteous gifts to the next generation of spiritual seekers so the organization continues to thrive for many generations to come.”

“I was blessed in my mid-20s to meet Reb Zalman, z”l, and other early Jewish Renewal creators and innovative leaders.

Jewish Renewal experiences (like Kallah), ongoing ALEPH learning and programming opportunities, and deep friendships continue to be the foundation of my life and connect me in the Four Worlds.

When I revised my will a few years ago, I was clear that I would add a legacy gift to express my gratitude for ALEPH, Alliance for Jewish Renewal. That bequest was easy to formalize, and my children are also aware of ALEPH’s meaning in my life.

While I continue to give annual gifts to ALEPH, I am reassured that my legacy gift will continue my support for ALEPH to evolve and innovate for generations to come.”

Sample Bequest Language

Unrestricted gift

“I give [specific dollar amount, property to be given, portion of residuary estate] to ALEPH: Alliance for Jewish Renewal, a Pennsylvania 501(c)(3) nonprofit organization (Tax ID: EIN: 23-2081703), to be used for its general educational and charitable purposes.”

Gift for the ALEPH Ordination Program (AOP)

“I give [specific dollar amount, property to be given, portion of residuary estate] to ALEPH: Alliance for Jewish Renewal, a Pennsylvania 501(c)(3) nonprofit organization (Tax ID: EIN: 23-2081703), to be used for its ALEPH Ordination Program.”

Gift for a Particular ALEPH Program or Service

“I give [specific dollar amount, property to be given, portion of residuary estate] to ALEPH: Alliance for Jewish Renewal, a Pennsylvania 501(c)(3) nonprofit organization (Tax ID: EIN: 23-2081703), to be used for [Insert Program Name.]

Endowment Gifts

Donors considering gifts for endowed scholarships, fellowships, or professorships should have their attorneys consult with an ALEPH representative before executing their estate planning documents, because certain minimum amounts and specific language are required. *For example, Rabbinic, Cantoral, Rabbinic Pastor, Hashpa’ah, Kallah, etc.

Why Your Legacy Matters

Your planned gift strengthens ALEPH’s mission: to educate, train and ordain leaders, build communities of spiritual practice, and co-create transformational experiences that build a global movement to reveal God’s presence in the daily lives of all humanity. Together we are creating a spiritual renewal of Judaism that is joyous, love- and justice-centered, earth-aware, and rooted in the legacy of our tradition — one prayer, one song, one step at a time.

Contact Us

Want to learn more or let us know you’ve made a gift?

📧 Galya Segal, Development Director

📨 galya@aleph.org

📞 215-247-9700 x200